Country Report Poland (DRAFT)

Jan Jakub Wygnanski

Poland currently is celebrating the 25th anniversary of democratic reforms. As the first country in this part of Europe Poland entered a complex process the symbolic beginning of which were the Round Table talks in 1988 leading to democratic elections. Part of the process of change (in fact both its cause and the consequence) was a specifically understood revitalization of civil society. Today this term has a lot of meanings but in the early 90s it was considered a kind of common denominator for the changes in this part of Europe. Its big advantage was the fact that it defined both political objective and a method that it was to be achieved.

Poland can probably claim to be one of the leaders of democratic and economic transformation. In both these areas (though more clearly in the economic section) the achievements are visible (e.g. as one of the few countries in Europe it coped relatively well with the recent crisis), also in the studies on the quality of democracy – although there is still a big gap in relation to the countries of the so-called “old EU”, Poland’s situation looks relatively well in comparison with other countries of the former Soviet bloc.

The same applies to specific indicators of the 3rd sector functioning (Freedom House[1], USAID’s NGO Sustainability Index[2]).

Adopted almost 20 years ago, the Constitution of Poland guarantees the freedom of establishment and activities of organizations. It is complemented by a series of specific laws regulating the activities of associations (1989), foundations (1984) and public benefit organizations (2003).

Based on research conducted regularly for over 20 years by non-governmental organizations (Klon/Jawor Association), we can quite well track trends related to these changes. Currently there are more than 100 thousand organizations operating in Poland, including over 11 thousand foundations. The non-government sector is an essential sustainable and systemic factor in Poland and it is involved in filling key functions, like provision of services, supervision of government actions, advocacy, social innovation, building social capital and ability to cooperate. Of course, each of these functions could be done better but they all are at least present and non-governmental environment is aware of the challenges that accompany them and actively searching for improvements. Currently the organizations even create, on their own initiative (on national and local level) a 3rd Sector Development Strategy; approx. 300 people are involved in its formulation.

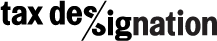

Chart – Dynamics of ngos registration (number of ngos newly registered in given year)

There are several solutions which have been implemented in Poland and would possibly be useful outside it. These include a national federation of organisations and considerable sectoral ability to act collectively, an extensive and generally available sectoral infrastructure in several dozen Polish towns/cities, generally friendly legislation, a stable system of research, well-working system of internal information, the 20 years old tradition of national-scale meetings of the sector (the so-called Fora of Non-Governmental Initiatives(FIP)), statutorily empowered organs of communication with Government called the Board of Public Benefit Activity on the national and many others on local levels, a considerable impact of the sector on the programming of funds from the EU (including the election by voting of several dozen representatives of the sector to bodies controlling the expenditure of the funds, a dedicated governmental Civil Initiatives Fund which has been operating for 10 years. Last not least statutory obligation to develop an annual program of cooperation with organisations in each of the 2500 communes in Poland. Legally guaranteed access to public media, tax incentive scheme (in excess of 1% PIT) for individuals and companies, encouraging donations for the benefit of organisations, etc. From that point of view 1% of PIT is just element of much wider supportive environment.

What were the key success factor(s) that was/were necessary to introduce the mechanism and why do you think so.

The work on the new law introducing 1% allocation started in 1996 and lasted for about 7 years. The idea of 1% allocation in Poland was a part of a broader legislative project aimed at an improvement of the conditions for the functioning of organizations, i.e. the Public Benefit Law. The main purpose of it was development of the so-called Third-Sector Constitution (and in particular its relations with the authorities). It should be stressed that 1% tax was not the most important issue. At that time, such questions as the regulation of access to public funds, “legalization” of voluntary service, and the separation of the category of public benefit organizations from among all the non-governmental organizations were much more important.

Many environments were involved in the undertaking: the government (in particular the Ministry of Labor and Social Policy). However, it was the NGO environment, and especially the people grouped around the Polish Forum of Non-Governmental Initiatives (Ogólnopolskie Forum Inicjatyw Pozarządowych), which played the most important role. The Forum was the nucleus of the national federation of organizations, which currently exists as a separate organization, while the Forum ceased to exist. The Forum conducted many advocacy activities for the benefit of organizations, including the triennial meetings of organizations from all over Poland, bringing together 1,000-2,000 persons, which took place in Warsaw. For several editions of the meetings, the bill and then the pressure to pass it was an important element of the forum.

The fact that the mechanism was introduced in other countries (including Hungary) was not doubt an important argument in favor of its introduction in Poland. At that time there was a sort of a “noble rivalry” in this scope – the level of mutual borrowings was high. One reason for the above was the presence of foreign institutions, which treated the region as a whole, and supported this form of exchange of experience. Initial intentions of 1% were only partially related to financial demands. It was supposed to be a kind of leverage and push for making sector more transparent and visible in the same moment and to promote authentic philanthropy among individuals (somehow beyond tax allocation).

The process of the allocation.

Finally system was introduced as part of new legislation Public Benefit Law in 2003 (art 27). Taxpayers were able to use allocation mechanism in 2004 for their 2003 fiscal year.

Basic elements of the 1% system:

Right to direct 1% of PIT applies to individual persons (including those who run one-person enterprises).

Beneficiaries of 1% PIT allocations include only NGOs, which obtained the status of public benefit organizations, including:

- NGOs understood as institutions, which are not public sector entities and do not operate for profit,

- legal persons and persons without legal personality, including foundations and associations,

- legal persons and organizational entities of the Polish National Catholic Church, and other churches and religious communities,

- associations of regional or local government bodies (Law of 04.2003).

Public Benefit Organization is a specific legal form of organization, which makes it possible for the institutions to use many privileges, including the 1% of income tax.

The donors can provide it to concrete organizations enjoying the status.

The method of separating public benefit organizations:

The PBO (Public Benefit Organizations) status can be obtained at the request of an organization. The decision on its issue is taken by the Registration Court which can also withdraw such a status. The conditions for being granted the status are, among others:

- carrying out public benefit activities (see the box) serving general needs of the community or a specific group of entities in a particularly difficult life or material situation;

- allocating the profit to public benefit purposes;

- having statutory authority of control or supervision (with no personal or professional relationship with members of the board);

- a ban on performing functions in its governing bodies of persons convicted for an offense prosecuted by public indictment or a tax offense;

- establishment of a statutory bans related to the assets of organizations (private use);

- in compliance with one of the conditions introduced in 2010 (Law of 22.01.2010), the organizations must incessantly conduct their public benefit activity for at least 2 years prior to applying for public benefit status.

PBO obligations

In order to provide better transparency to the general public, public benefit organizations submit and present their substantive and financial report to the minister competent for social protection. The report has quite an extensive form (depending on the size of organizations). The report is submitted online and creates a publicly available database. Information submitted by public benefit organizations include sections describing revenues and expenditures, broken down by their types, in particular in relation to the 1% PIT mechanism, as well as expenditures covered with them (along with those that have been incurred in collecting the 1% PIT). A special part of the report consists of information about salaries in organizations.

In case of failure to report in a timely manner, the privilege of getting the 1% PIT is suspended. The list of NGOs with the right to use the 1% is a public document, announced not later than on 15 December each year. Currently nearly 9 thousand organizations have such a status.

From January to the end of April each year the PIT-taxpayers may indicate one of the public benefit organization as the beneficiary of the 1% of their PIT tax (it is necessary for this purpose to enter the corresponding number from the registry). The individual tax offices transfer funds to such organizations mentioned in the tax return.

The list of PBO is available on official websites; often it is attached to electronic tax return-filling programs. Many organizations conduct media campaigns, in time of filling tax returns, to convince taxpayers to direct the 1% PIT to them.

In the tax return form you can enter the so-called detailed aim, which should allow you to indicate the purpose of the organization’s activities (e.g. one of its programs). In practice this mechanism has been used as a form of disposal for payments to individuals collecting funds through the organization. (We will talk on that matter below).

Every year the Ministry of Finance makes public a list of all public benefit organization, with the amount of the 1% PIT they obtained in the previous year.

Scale of the phenomenon

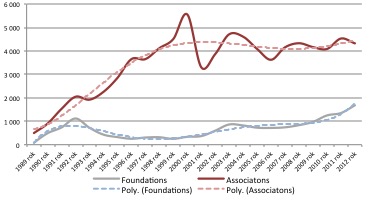

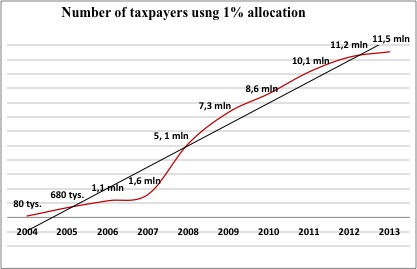

The popularity of the mechanism skyrocketed. In 2004, the being the first year of the arrangement on the 1% PIT, only 80 thousand taxpayers directed the amount of PLN 10.4 million to such beneficiaries, which accounted for 0.03% of the tax due. For comparison, the amount transferred in 2014 amounted to PLN 506 million and represented 72% of the total tax due.

We can say then that this phenomenon is now widespread. Virtually everyone who fills the PIT tax return by himself (which means all taxpayers with exclusion of pensioners and some persons employed in one workplace, where the tax return can be filled by the company’s accounting services) use this mechanism. The average value of 1% PIT directed by taxpayers to NGOs in 2014 is the equivalent of approx. 10 EUR.

One of the major challenges here is the huge scale of the diversification (concentration) of the 1% PIT revenues among various organizations. In 2014, when uch payment was made to nearly 7.5 thousand organizations, over 25% of the total sum was collected by literally one foundation, which for years gathers fund through its so-called sub-accounts, directing the funds to individual people. 10 organizations from the top of the list (six of them is known as “intermediary in collecting funds” for the benefit of individual persons or institutions that do not have the PBO status) collects approx. PLN 180 million (for the whole amount of PLN 500 million obtained in 2014 from the 1% PIT mechanism). This kind of disproportion can be considered to some extent as pathological and is a source of frequent criticism of the entire mechanism of 1% PIT.

The popularity of the 1% PIT mechanism could consider a success stemming from many factors. The most important is probably the easiness of the very operations of transferring the 1% of one’s PIT. This action literally costs nothing, beyond entering a number in the tax return. Significant is also the enormous media activity of NGOs during the period of filling tax returns – in all possible ways the organizations try then to convince taxpayers they should donate the 1% PIT to them. Often, the quality of these campaigns and their purely emotional character is of poor quality. The campaigns are conducted using all possible media. Part of organizations (even those with no PBO status) try to use the mechanism of 1% PIT, applying external “brokers” who obtained a part of the revenue. In other countries they set up separate organizations – in Poland they use the existing ones. We must also distinguish here between public institutions of universal access (e.g. museums) from those that limit their services to a specific group (e.g. schools and kindergartens, which themselves inform, e.g. the parents, about the possibility of making the 1% PIT payments).

One of the arguments that might persuade you to transfer part of the tax for the benefit of the organizations is a unique and quite critical attitude of a part of the taxpayers to the efficiency of public administration and the way in which public money is spent. The research of the Klon/Jawor (2015) on the image of the organizations shows that 58% of respondents believe that NGOs are more effective in their actions than public administration. Although it comes from a negative conclusion, it is a real incentive, resulting from the critical attitude of Poles to their own country and the very obligation to paying taxes.

What has changed in the system during its life, what were the policy reasons behind them (changes), and what effect have the changes had

The 1% Law was amended several times. From the point of view of tax allocation, the most important change was introduced in 2006 – the possibility of allocation was extended to include self-employed individuals (i.e. persons conducting individual economic activity, and paying flat tax). Another important element of this amendment is a major change of the 1% transfer mechanism. Since 2006, the tax office has been transferring the monies on behalf of the taxpayers.

This solution has dramatically increased the number of people using the mechanism and the amounts reaching the sector. Works on the introduction of the subsequent amendments to the law are just about to be completed. Many of the changes concern relations with the local authorities, and there are also several cosmetic changes concerning the 1% mechanism. In particular, more meticulousness in the area of informing the public about the amounts collected and spent for the particular goals will be required (with the help of a publically available register of reports).

While working on the amendments, the legislators also discussed various other questions, such as the necessity to inform the public about the cost of the 1% campaigns or the alternative determination of limits of cost of such campaigns, or the very technical issue consisting in the introduction of a ban on the distribution of computer software for tax settlement in which it would be possible to select only the entity distributing the software as the 1% beneficiary rather than choosing such beneficiary from the full list of organizations. Due to problems with the correct formulation of both amendments, works on them have been recently discontinued.

In Poland, the 1% PIT mechanism had quite ambivalent consequences. On the one hand it has clear advantages: in nominal terms, it provides the sector with approx. PLN 500 million, i.e. about 3-5% of the total revenue of the sector. The mechanism also forced public benefit organizations to use much more transparency as well as gave them a reason for a better communication with the public. Without any doubt it increased the visibility of NGOs (public benefit organization) and actions that they lead. On the other hand, the list of restrictions and even malfunctioning of the system is quite long. The NGOs’ communication with the public is in most cases based not on rational argumentation but rather on emotions (if not emotional blackmail). This is one of the reasons why e.g. respondents of the Klon/Jawor 2015 study incorrectly assumed that NGOs are involved in helping the needy (79% of the respondents think so), although in fact such activities constitute only 6% of the activities of the sector. The assumption that the taxpayers would in their decisions be directed by available data (each organization must supply them), proved to be wrong. The most important disappointment that accompanies the 1% PIT mechanism is, however, the fact that the mechanism does not stir genuine philanthropy but rather limits it. The 1% mechanism has been falsely portrayed as a kind of philanthropy and perhaps this is why replaced it rather than awaking. The 1% PIT is in its essence closer to the principles of participatory budget – as it increases public access to the disposal of public money – but no one promoted it in this way. In Poland, fortunately, the introduction of the 1% PIT left “untouched” incentives for traditional philanthropy – still both in case of PTI and CIT tax base can be reduced by 6% which would be transferred to charity.

The problem is also the fact that the mechanism was somehow privatized (and it was meant to serve public benefit). Basing on the theory of goods, we may state that too often feeds the 1% PIT feeds the so-called club goods (available to a small group), or even individual one (support for individuals). These are very popular targets of the 1% PIT and they rake in a significant part of the total amount. The role of the organization is limited to the role of an intermediary – and this does not mean appreciation of their competence as prudent re-distributor (it is not the case of United Way or Community Foundation) – the role of the organizations here is purely mechanical and they simply obtain profit from such agency.

Another problem is in our opinion the fact that the public benefit status has been reduced almost exclusively to a mechanism for official registering of an access to the 1% PIT. The intentions of law-makers were different – the status was meant to define a special competence and quality of organizations on the basis of declared documents of a given NGO. For most people however this status means an entitlement to spend the 1% of PIT according to their will and no real commitment to working for charitable purposes.

Why is the system important for the country and overall assessment of its value compared to other forms of public funding of civil society and other instruments in involving taxpayers in deciding on public budgets?

The principle of the 1% PIT mechanism is not, as we have already stated, seen by most of the public as public funding but rather as a kind of personal philanthropy. In parallel, there are a number of mechanisms of public funding, both at national and local levels. In total, more than half of the non-governmental sector funding comes from public funds (domestic and foreign -mainly EU programs). Apart from a small group of organizations, the 1% is regarded rather as a supplement to the traditional budget. Its advantage is the fact that, unlike public funds (which are subject to many conditions), this funding is much more flexible.

The 1% mechanism, due to its popularity, appears more often lately as a possible model for the financing of churches, political parties and even public media. A separate issue is the occasionally appearing idea to start, using the example of the neighboring Slovakia, a similar 1% mechanism in relation to the CIT (companies’ revenue) tax.

Table: Role of 1% allocation in overall “diet” of the 3 sector (based on PBO reports n 2012)

| Total income (PLN) | Income form 1% allocation (PLN) | Total income from public sources (incl 1%) (PLN) | ||

| Average | 742 859 | 52 461 | 275 920 | |

| Suma | 5 409 498 792 | 382 019 151 | 2 009 246 387 | |

| Decilies | 10 | 6 729 | – | – |

| 20 | 17 397 | – | – | |

| 25 | 24 302 | 202 | – | |

| 30 | 33 778 | 793 | – | |

| 40 | 56 407 | 1 949 | – | |

| 50 | 93 229 | 3 558 | 7 000 | |

| 60 | 151 223 | 6 117 | 21 908 | |

| 70 | 270 613 | 10 492 | 51 551 | |

| 75 | 377 355 | 14 236 | 80 153 | |

| 80 | 549 328 | 19 805 | 135 570 | |

| 90 | 1 374 373 | 47 220 | 532 552 |

In country information and knowledge resources regarding the mechanism.

Poland has a relatively well developed infrastructure of research and information dedicated to issues of the 3rd sector. In particular, we should take into consideration the activities of the Klon/Jawor Association which maintains a database of NGOs and every two years conducts a study of the condition of 3rd sector (based on a representative random sample of organizations – from 2 to 4 thousand organizations). Every year Klon/Jawor runs also a research of volunteering and 3rd sector perception. (www.ngo.pl ). Klon also provides data in the form of a publicly accessible data repository (you can use it to track data, including the data on 1% PIT (the dynamics, geography, relationships between data – www.mojapolis.pl).

In parallel, there is a working group set up in the Central Statistical Office which conducts research of the sector www.stat.gov.pl

A specific source of data on public benefit organizations and the 1% mechanism is the annual list of public benefit organizations, a publicly available database of annual reports of these organizations as well as a list, published each year, of all beneficiaries of the 1% PIT, with the amounts granted www.pozytek.gov.pl

The law on public benefit (a part of which is the 1% mechanism) has also records that require regular parliamentary reports on the effects of the law.

A limitation of the above-mentioned sources is, from the point of view of this report, the fact that practically all of these sources are available in Polish only.

[1] https://freedomhouse.org/sites/default/files/FH_NIT2015_06.06.15_FINAL.pdf

[2] https://www.usaid.gov/sites/default/files/documents/1863/CSOSI-Report-FINAL-7-2-15.pdf